What Are Some Of The Biggest Risks Retirees Face?

Retirement can be the time of one’s life, where dreams of traveling the world and enjoying life to its fullest finally come true. But retirement is not without risks and without proper planning and financial discipline, the worst fear of many retirees could come true: they could run out of money.

While there are many factors that could cause a retiree to have to lower expenses in retirement or cut back on their lifestyle to avoid running out of retirement savings. In this post, we’re going to look at three common post-retirement risks that people approaching retirement age are likely to have to deal with down the line: longer lifespans, potential cuts to social security, and high inflation rates.

Retirement Risk #1: Longevity Risk

The Financial Challenges of Longer Lifespans

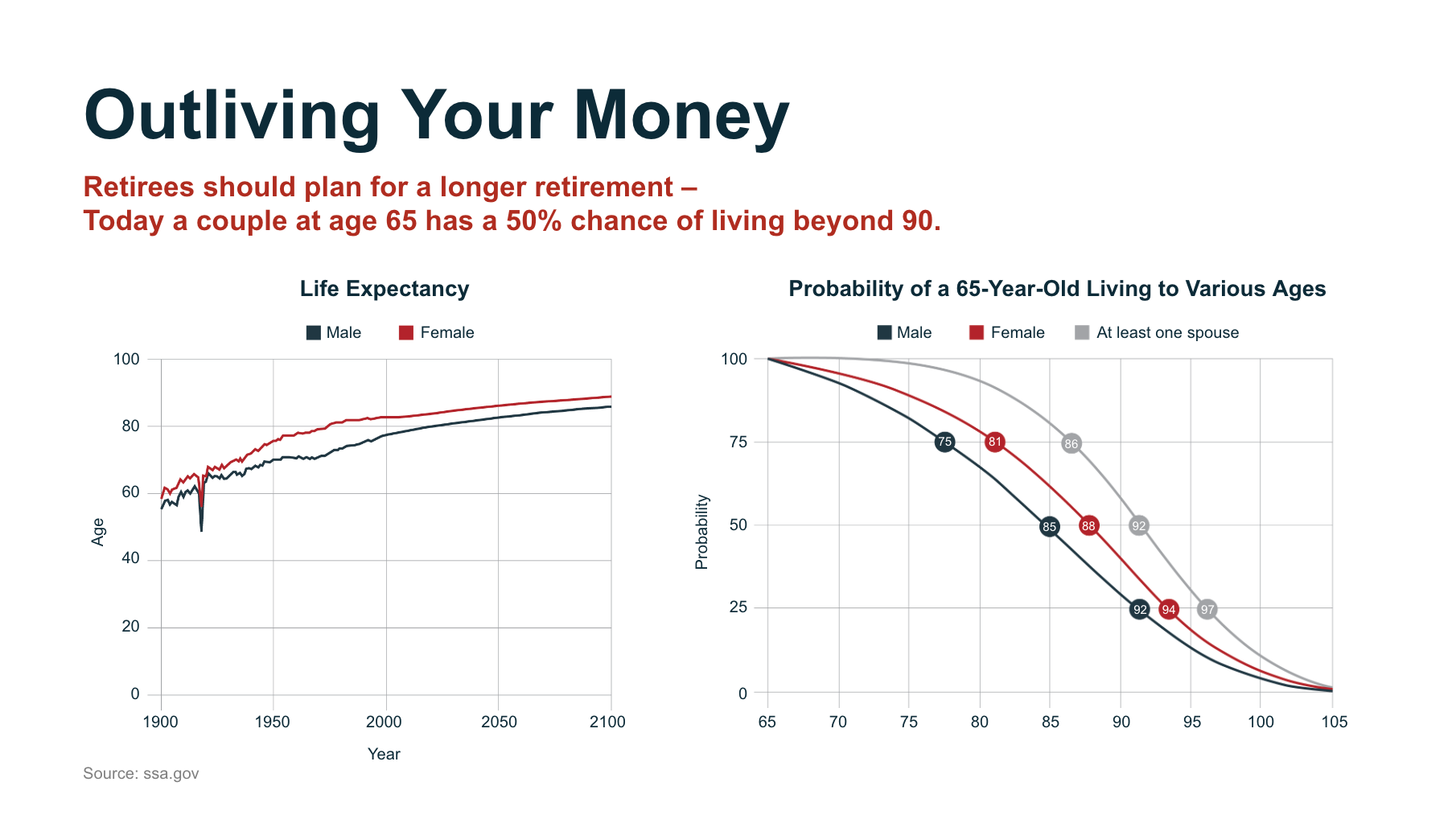

Having a longer life expectancy is objectively a good thing, but living longer brings its own challenges and retirement risks. With life expectancies at all times highs due to advances in healthcare and technology, retirees are living longer than ever before — according to the Social Security Administration, the life expectancy of a person reaching age 65 today is over 20 years versus just under 14 years in 1940 — which means retirement savings have to last longer.

Additionally, one of the biggest financial challenges that living longer could bring is unexpected medical bills, increased medical costs, and the potential need for costly long-term care. It is important to plan for these potential medical expenses in advance to minimize the risk of an unexpected healthcare event draining out your savings, even if you are in good health as you approach or enter retirement. The costs of healthcare and long-term care alike have been on a consistent march upward for many years — as has been insurance, and Medicare famously does not provide long-term care coverage.

Planning for a longer retirement

If you’re in or approaching the preservation financial phase of life, you still have time to significantly increase how much you have saved for retirement. There’s even been some help from Congress. Thanks to the Secure Act 2.0, workers over 50 will be able to make larger catch-up contributions to their retirement accounts starting in 2023. Depending on how much you think you’ll be able to save, it might make sense to work longer — though you may be able to switch gears to working part-time or in a consulting role instead of full-time. Younger people still in the accumulation phase should also make sure they are saving more for retirement so that they have more assets to work with.

RETIREMENT TIP:

For people already in retirement, options are limited. Riskier investment strategies are generally not a smart choice at this stage of life as the potential cost of a risky investment going wrong is too high. Returning to work is an option available to younger retirees still in good health, though perhaps not a desirable one. Otherwise, you’ll need to reduce your living expenses to help your money last longer.