Since local governments first ordered the shutdown of the economy, there has been a tremendous amount of stimulus measures have been unleashed by Congress while some of the stimulus has been focused on protecting the workforce and keeping the US economy from falling into depression while some have geared towards virus testing.

This, undoubtedly, is confusing to follow, and it’s regularly mentioned in the news and continues to influence the market movements as stimulus news pops up and makes headlines. As such, I’ve prepared a simple outline that highlights the timing and difference with each phase.

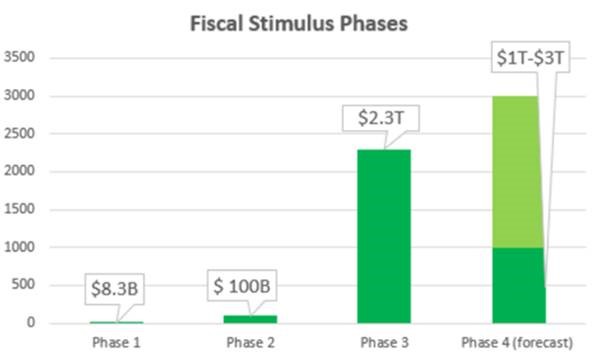

Phase 1: $8.3 Billion

The primary purpose of these initial funds was to stop the spread of the virus and learn how to prevent infection rates from continuing to rise exponentially, which as the case early on during the outbreak.

Phase 2: $100 Billion

These funds were primarily used for increasing testing capabilities, as stopping the peak of the virus was still the government’s top priority due to the seemingly uncontrollable outbreak in the middle of Q1. Phase 2 also included initial funds for things such as unemployment and sick leave for the hardest-hit sectors before the scale of the economic fallout could be calculated.

Phase 3: $2.3 Trillion

This was when the stimulus funds began to flow in late March, and cash importantly began to make its way into the pockets of the people who were being most negatively impacted by the pandemic. The Paycheck Protection Program (PPP) was the primary vehicle for delivering those funds to the small and medium-sized businesses that otherwise wouldn’t have been able to cover payroll.

Looking at the numbers, Phase 3 included $510 Billion for large business loans, $377 Billion for small business loans (both of which are mostly forgivable), and $280 Billion in business tax breaks that offer at least a 12-month extension to the original 2020 deadline. Regarding individual households, payments of $1,200/adult, and $500/child totaled $290 Billion, Unemployment Benefit supplements came to $260 Billion, while general health funding and aid to state/local governments came out to $330 Billion.

Along with a lot of accommodative actions by the Fed, including buying corporate bond ETFs, the Phase 3 stimulus helped stop the historical stock market rout in late March that saw the S&P 500 drop more than 30% peak to trough in a matter of a few weeks.

Phase 4: $1-3 Trillion

The Phase 4 package is far from finalized, and the range between what House Democrats have proposed is necessary, and the number that Senate Republicans have countered with is nearly as massive as the Phase 3 package.

Phase 4 is largely expected to be finished next month, and with the Trump administration revisiting the top of a $1 Trillion infrastructure package earlier this week while congressional Democrats continue to push for more direct stimulus payments to US citizens, the odds that Republicans and Democrats meet somewhere in the middle of the proposed rage of $1-3 Trillion is becoming increasingly likely. Meaning, we could see another $2 Trillion moving through Congress within the next month.

The Bottom Line

Phases 1 and 2 of the fiscal stimulus response to the COVID-19 pandemic were nominal compared to the more than $2 trillion Phase 3 package that passed in late March. Looking ahead, even the low-end estimates have a Phase 4 package at over $1 trillion.

Historically speaking, that is an unprecedented amount of fiscal stimulus and paired with the Fed slashing rates and rolling out multiple forms of quantitative easing to keep markets “functioning” properly, it is now reasonable to say the term “don’t fight the Fed” can be used for both the Federal Reserve Bank and the Federal Government as spending on the scale seen so far in 2020 has proven effective in containing the economic fallout from the pandemic as evidenced by the better-than-expected rebound in economic data since the depths of the shutdowns in April.

Unless Phase 4 is a major disappointment (say below $1T total), or the Fed hints at removing current market-friendly accommodation (unlikely soon). Stocks should be able to continue to grind higher in the weeks ahead as the Phase 4 package comes into focus, especially if we continue to see economic numbers beat expectations the way Retail Sales did.