In response to Russia’s invasion of Ukraine, many countries have imposed sanctions, bans, and other coordinated actions focusing on state-owned businesses and high-profile Russian public figures and businesspeople. These economic measures have disrupted Russia’s economy by limiting its access to capital markets, technology, and imported goods.

Because of Russia’s position as a key supplier of multiple raw materials (oil, nickel, wheat, and more), these measures, along with Russia’s counter-actions (plus disruptions of supply chains connected to Ukraine itself, which are not insignificant) have caused a spike in inflation (especially in food and fuel) across the world. This has further challenged central banks, which were already dealing with ongoing supply-chain issues and robust demand pressures that had caused inflation to run hot.

The stock market has also felt the effects of the conflict and its wild swings have left many investors squirming.

A reminder that chaos can come from any direction and at any time

Volatility is uncomfortable, but it’s also normal—and an expected (if unpredictable) part of investing.

The world may be focused on the Eastern European conflict at the moment, but this is far from the first geopolitical event that has turned markets on their ear. And, unfortunately, it also won’t be the last. From the COVID-19 pandemic to the global financial crisis of 2007 to the bursting of the tech bubble in 1999 and other catastrophes beyond that, disruption comes in many forms.

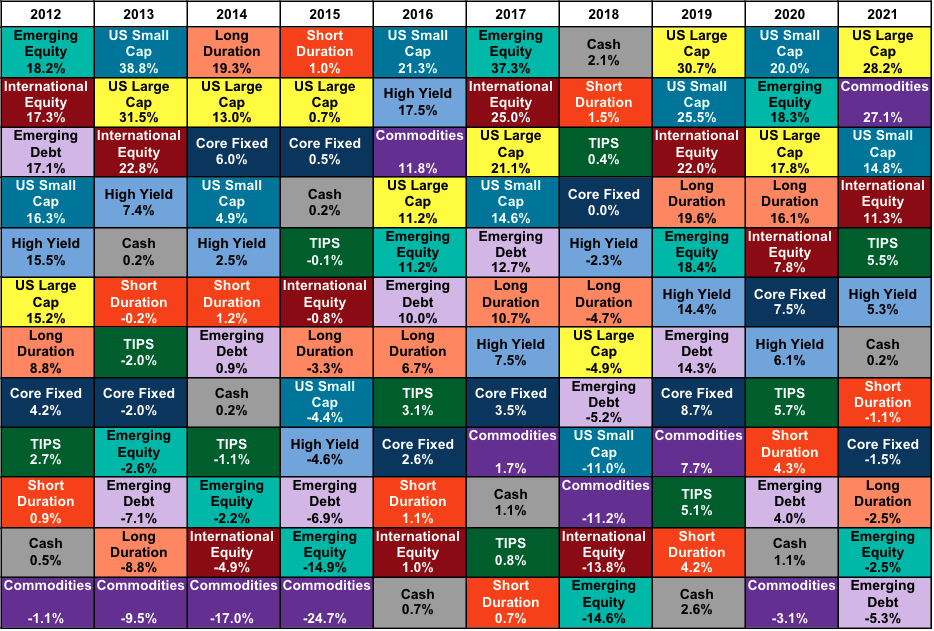

Now for some perspective. Below is a chart that may provide some reassurance in times of market trouble. Each year, there are different winners and losers (in terms of asset classes). The investments that were superstars last year probably won’t be winners next year—or in three years, or even in five years. The same goes for the losers.

The chart underlines the importance of having a diversified portfolio. Diversification is one of the best ways to both reduce the risk of total loss and to increase your chances of having investment success over the long term.

Souce: index providers. Annual performance shown from Jan 1, 2012 through Dec 31, 2021. Asset-class proxy indexes: Russell 1000 (U.S. large cap); Russell 2000 (U.S. small cap); MSCI EAFE (international equity); MSCI Emerging Markets (emerging market equity); Bloomberg U.S. Aggregate Bond (U.S. core fixed income); Bloomberg U.S. Corporate High Yield Total Return (U.S. high yield); 50% J.P. Morgan EMBI Global Diversified/50% J.P. Morgan GBI EM Global Diversified (emerging market debt); Bloomberg 1-5 Year U.S. TIPS (U.S. Treasury inflation-protected securities); Bloomberg Commodity (commodities); Bloomberg U.S. Long Government/Credit (U.S. long duration bonds); ICE BofA 1-3 Year U.S. Treasury Index (U.S. short duration bonds); ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity (cash).