When it comes to investments, most people want to focus on annualized rates of return.

Why? There are numerous reasons, but the one that sticks out in my mind is simply the fact that we like winners. We want to select the strongest-looking funds in our portfolios because we believe that will give us the best chance at retirement success.

Annualized rate of return is often confused with annual rate of return, which is calculated yearly. This misunderstanding often leaves investors with a skewed expectation of how their stock, fund, or strategy will perform.

Though it can be wise to look at annualized rates of return when investing, a better calculation to consider is standard deviation.

What is Standard Deviation?

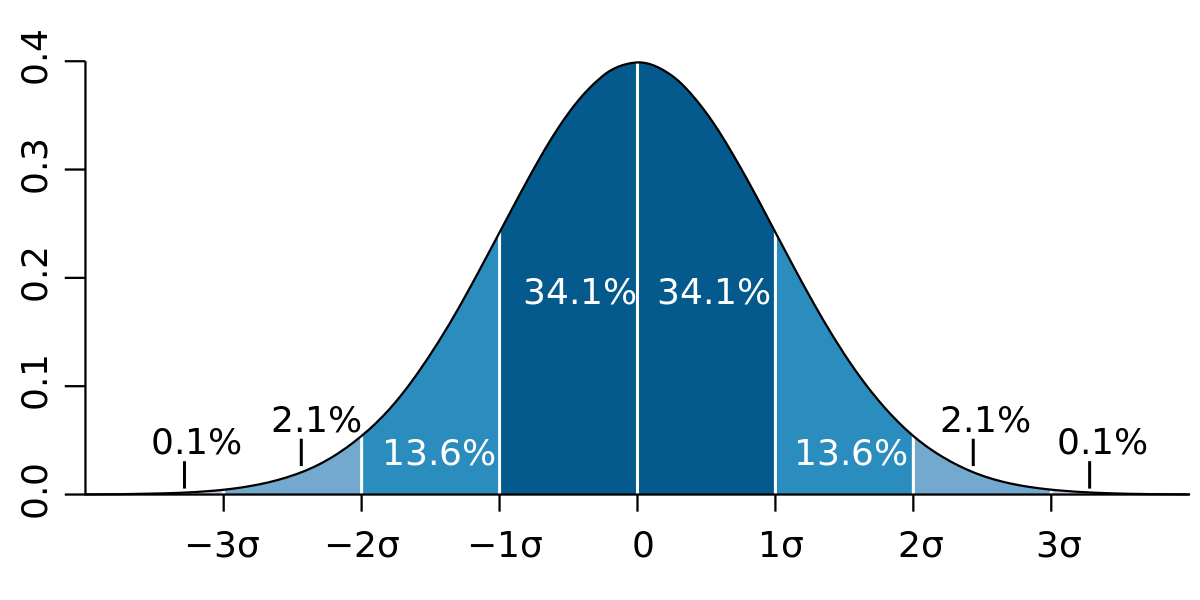

The standard deviation is a measure that is used to find the amount of dispersion within a set of data.

Think back to your statistics class and those fun bell curves. When calculating the standard deviation, the data is laid out to find high and low points. Those points help us find a mean or average. We can then see the dispersion between the mean and the high or low.

Example from wikipedia.com

That is a very simple look at standard deviation. So simple, in fact, that my high school stats teacher might beat me up over it!

Let’s take a look at why standard deviation matters in the financial world.

How Standard Deviation Relates to Your Retirement

Standard Deviation is a crucial calculation to consider because it can have a dramatic impact on your ability to retire (and stay retired) without running out of money.

As I said earlier, we like winners. But, what do we like even more than winners?

Consistency.

Ultimately, consistency will allow us to have much more confidence in our retirement planning, especially regarding our portfolio’s performance.

To achieve more consistent returns, the goal should be to tighten the bell curve (or dispersion) of your standard deviation.

With a reduced standard deviation, it’s possible to have a lower annualized rate of return, but a far better probability that your retirement goals will be met.

Let’s look at an example.

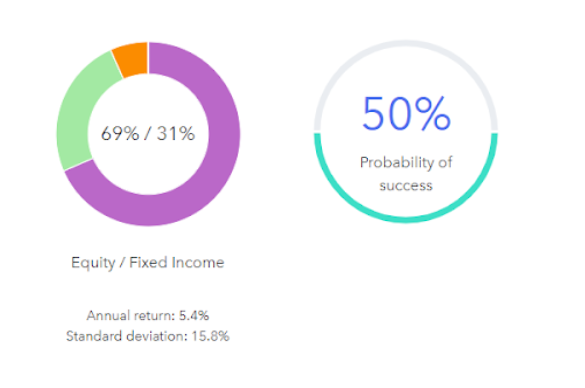

A person with specific retirement goals could have an investment strategy that leaves them with an annualized return of 5.4% and a standard deviation of 15.8%. That strategy, coupled with their goals, might lead to a less than desirable probability of meeting/funding those goals, as you can see below.

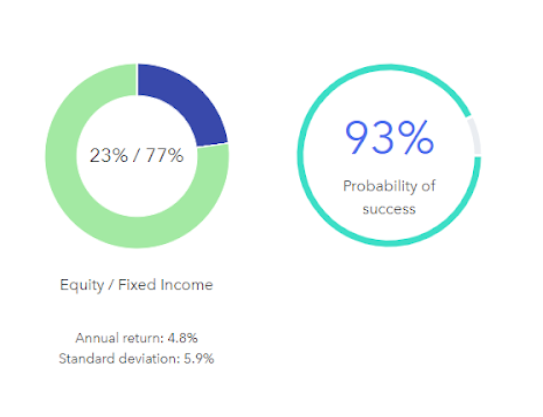

By deploying a strategy that might reduce the annualized rate of return and their standard deviation (or “wiggle,” as I like to call it), an investor could experience more predictability from their portfolio.

Predictability means that wiggle and stress could be replaced with confidence and a more desirable outcome.

The above is simply an example. Each strategy requires its own mix of asset classes. If you have questions, it’s best to have a talk with your financial advisor.

What is a “Good” Probability of Success?

There is an industry standard that says, in the retirement world, any probability of success over 75% means you’re potentially “overfunded” for retirement.

Every person that sits across from me laughs when I use the term “overfunded,” and I think they’re right to do so.

If we were driving across Death Valley in the peak of summer and I told you there was a 50% chance we’d make it across that barren landscape with the fuel we have, you probably wouldn’t feel very confident. In fact, you’d likely be terrified.

What if I told you that we had a 75% chance of making it across and that the Death Valley which, by industry standard, means we’re a shoo-in to survive? You’d look at me like I was crazy.

You’d likely feel much more confident the closer we got to a 100% probability. Same goes for your retirement.

Bottom Line

While returns are smart to look at, standard deviation is better. With both correctly assessed and implemented within your strategy, you can very likely improve your outcome in retirement.

Ready to discover your probability of retirement success?